The HVAC industry trends in 2026 reflect a global shift toward efficient, healthy, and technology-enabled indoor climate control systems. Environmental policies, rising indoor air quality expectations, and building electrification initiatives are reshaping the adoption curves of heating and cooling across the world. Countries such as India, the UAE, and the USA are experiencing accelerated HVAC modernization driven by real estate growth, increasing temperatures, and stricter energy-efficiency standards. In parallel, the heating and cooling industry is undergoing a competitive transformation, as companies move from purely equipment-driven economies to data-supported service ecosystems that optimize both performance and operational costs. This represents a turning point where trends in HVAC align with digital controls, energy intelligence, and building sustainability mandates.

Regulatory, Economic, and Climatic Drivers Behind HVAC Technology Trends

Environmental regulations, real estate expansion, and economic incentives form the backbone of emerging HVAC technology trends for 2026. Governments are tightening refrigerant policies to reduce greenhouse gas emissions, compelling manufacturers to innovate with low-GWP alternatives and energy-optimized components. In the USA, SEER rating upgrades and decarbonization goals are accelerating the migration to heat pumps for residential and commercial buildings. Meanwhile, the UAE’s desert climate maintains a high baseline demand for cooling, prompting district cooling adoption and IAQ mandates for luxury developments and hospitality. India’s rapid urbanization, rising per-capita AC usage, and infrastructure development are driving HVAC penetration in metro cities and Tier 2 real estate clusters. Collectively, these forces are enhancing the future of HVAC while boosting long-term HVAC industry profit margins, especially in retrofit and service categories due to extended equipment lifecycles and predictive maintenance models.

Key regulatory drivers shaping 2026:

- Energy performance standards for buildings

- Low-GWP refrigerant mandates and HFC phase-downs

- Electrification of heating systems across Western markets

- Subsidies promoting heat pump deployment

- IAQ and ventilation compliance in commercial infrastructure

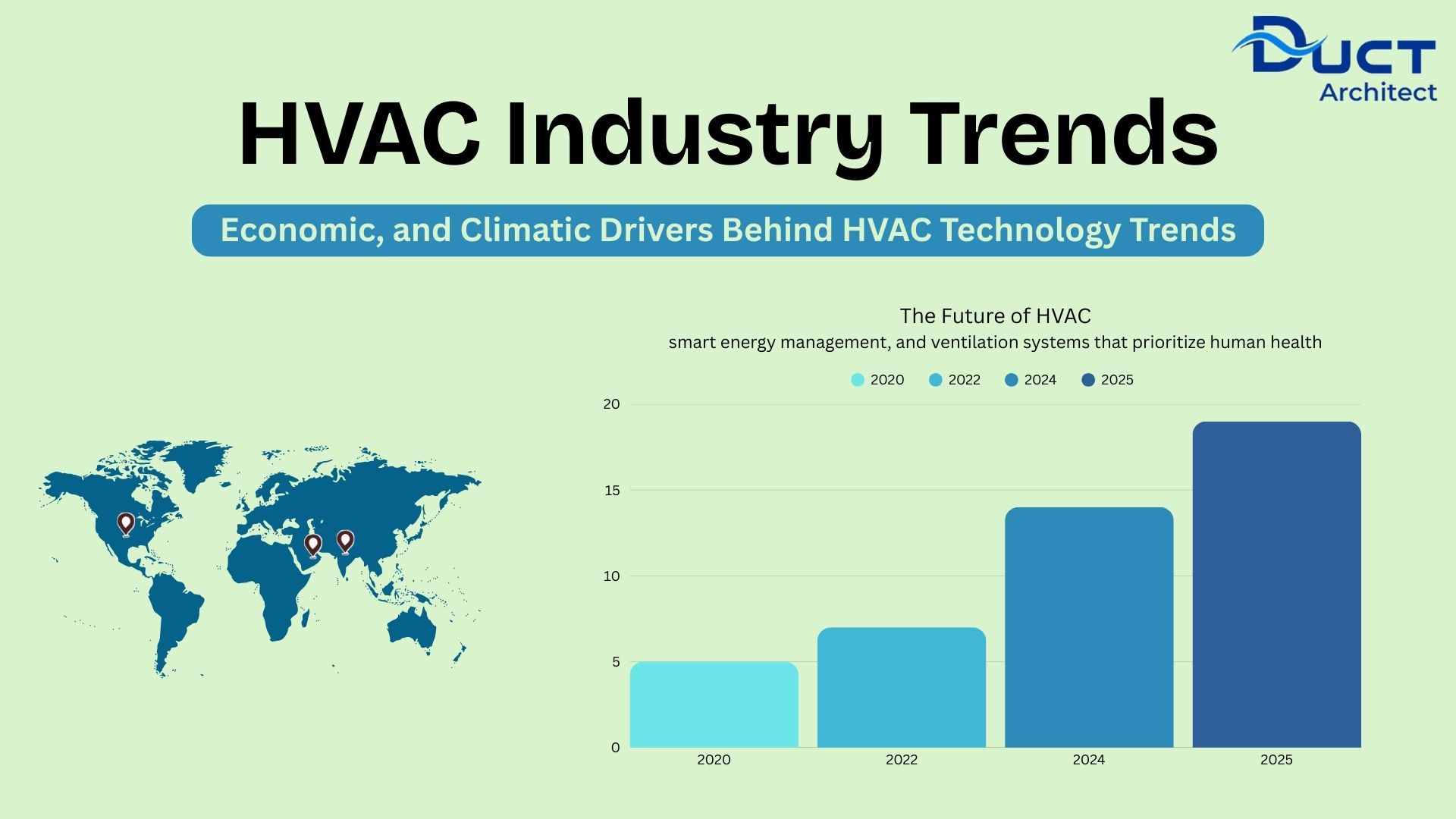

The Future of HVAC: Digitalization, Electrification, and Fresh Air Conditioning

The future of HVAC is deeply intertwined with digital building controls, smart energy management, and ventilation systems that prioritize human health. The pandemic era elevated expectations around IAQ and filtered ventilation, leading to mainstream adoption of fresh air conditioning systems via ERV/HRV ventilators, high-efficiency particulate filters, and CO₂-sensitive ventilation logic. Electrification of heating, especially with performance heat pumps, is replacing combustion-based heating in the USA, EU, and selective UAE markets. For India, inverter-driven AC units and VRF systems represent the transition toward higher performance in high-density commercial buildings and premium residential towers. These adoption shifts are being further reinforced by smart thermostats, cloud-connected facility dashboards, and AI-driven load optimization that collectively reduce building energy intensity and support green certification pathways.

Core future-oriented technology themes include:

- Multi-zone inverter VRF/VRV deployments

- IAQ enhancement through filtration and ventilation

- IoT-supported smart homes and BMS integration

- Heat pump electrification in residential upgrades

- Predictive diagnostics and performance analytics

Regional Adoption Landscape for 2026 (India, UAE, USA)

India

India’s HVAC market is characterized by rapid consumption growth, driven by warmer summer temperatures, real estate expansion, and greater AC adoption among middle-income households. Commercial buildings, IT parks, healthcare facilities, and retail sectors are expanding their reliance on VRF systems and IAQ-integrated HVAC installations. The country’s refrigerant and energy efficiency policies are pushing manufacturers toward non-HFC alternatives and high-efficiency compressors, while inverter technology becomes more standardized across urban consumer markets.

India 2026 key points:

- Strong residential AC penetration in metros

- VRF installations in commercial real estate and malls

- Growth in AMC service and retrofit markets

- IAQ-sensitive demand in hospitals and schools

UAE

The UAE represents one of the most advanced global cooling markets due to its climate and real estate architecture. District cooling is gaining significant traction in luxury residential clusters, airports, hotels, and retail complexes. IAQ and humidity control are essential differentiators in new construction, often tied to health, performance, and comfort standards set by high-value buyers. Digital infrastructure, including BMS platforms and remote energy monitoring, allows the region to optimize cooling loads and reduce peak operational expenses.

UAE 2026 key points:

- District cooling expansion linked to real estate master plans

- IAQ-driven luxury building compliance

- Demand for advanced chilled water systems

- Cloud-based energy management for utilities and developers

USA

The USA market is transitioning aggressively toward heat pump adoption as part of national electrification strategies aimed at reducing fossil fuel dependence in buildings. Retrofitting old HVAC units with smart controls and low-GWP refrigerants remains a major revenue channel. Residential consumers increasingly integrate HVAC with smart home ecosystems, demanding data visibility, scheduling, and remote configuration. Schools, universities, and healthcare facilities prioritize air quality as a direct health investment.

USA 2026 key points:

- Electrification of heating via high-performance heat pumps

- SEER upgrades influencing equipment replacement cycles

- IoT + smart building management demand growth

- IAQ investments in institutional facilities

Profitability Outlook and Service Ecosystem Expansion

The shift toward software-enabled maintenance and energy optimization is improving HVAC industry profit margins, especially in aftermarket operations. Manufacturers and contractors are transitioning from one-time equipment sales to recurring service-driven strategies. Predictive diagnostics are reducing downtime, improving component longevity, and generating value-added revenue streams across monitoring platforms and AMC service renewals. Retrofits and regulatory compliance upgrades create profitable sales cycles, particularly in commercial buildings and aging infrastructure segments.

Profit margin enhancement drivers include:

- Spare parts and consumables sales

- Maintenance and retrofit contracts

- IAQ and filtration upgrade kits

- Energy performance consulting

- Smart controls and BMS integration services

Conclusion

The global HVAC industry trends for 2026 reflect a decisive move toward sustainability, digital building intelligence, and IAQ-driven comfort enhancements. Policy incentives, technology maturation, and end-user health awareness are accelerating adoption both in mature and emerging markets. India, the UAE, and the USA are aligned on efficiency and environmental priorities, although adoption strategies differ according to climate conditions, infrastructure patterns, and regulatory maturity. These structural changes underscore that the heating and cooling industry is no longer solely a hardware domain, it is becoming a networked energy ecosystem.

Organizations seeking competitive advantage in the future of HVAC will increasingly adopt design automation, modeling software, and digital controls to optimize equipment sizing, improve design accuracy, and reduce operational inefficiencies. In particular, HVAC engineers and contractors can benefit from Duct Architect software for streamlined ducting workflows, project planning, static pressure analysis, and load considerations. Its integration into design operations reduces iteration time, minimizes layout errors, and supports modern IAQ and ventilation planning requirements for residential, commercial, and institutional building projects.

FAQs

1. What are the top HVAC industry trends for 2026?

Key trends include heat pump electrification, IAQ-driven fresh air systems, VRF deployment, smart building controls, low-GWP refrigerants, and predictive maintenance platforms.

2. Why is indoor air quality becoming so important?

IAQ supports occupant health, performance, and compliance in buildings such as schools, hospitals, and commercial spaces, prompting investments in filtration and ventilation.

3. How are refrigerant regulations influencing product design?

HFC phase-down rules are driving manufacturers toward low-GWP refrigerants and redesigning components for compatibility, efficiency, and environmental performance.

4. Will heat pumps replace gas heating in the USA?

Yes, adoption is increasing due to electrification incentives, carbon reduction policies, and performance improvements in cold-climate heat pump models.

5. What role do smart controls play in HVAC efficiency?

Smart controls optimize load scheduling, reduce peak consumption, and support remote decision-making for multi-site facilities via automation and analytics.

6. How does district cooling impact energy usage in the UAE?

District cooling centralizes chillers to reduce individual building loads, improving energy efficiency and supporting large-scale real estate development goals.

7. How is India’s HVAC market evolving?

Urbanization and real estate expansion are driving VRF, inverter AC, and IAQ-enhanced system adoption, while AMC services improve lifecycle management.

8. What are the profitability opportunities for HVAC companies?

Recurring revenue models in maintenance, retrofits, spare parts, and digital diagnostics support higher HVAC industry profit margins beyond equipment sales.

9. What technologies define the future of HVAC?

AI-driven energy optimization, BMS integration, heat pumps, advanced filtration, low-GWP refrigerants, and cloud analytics.

10. How does fresh air conditioning support modern buildings?

Fresh air systems improve ventilation, reduce CO₂ levels, and support humidity and filtration control, which are essential for healthier indoor spaces.